take home pay calculator married couple

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

Salary Calculator Calculate Salary Paycheck Gusto

You can calculate VAT in France using the France VAT Calculator.

/will-i-pay-tax-on-my-home-sale-2389003-v5-73871af4e690411c8fc3e03de02cb241.png)

. Web Take home pay calculator married couple Tona Horsley. Subtract any deductions and. For tax purposes whether a person is classified as married is based on the last day of the tax year which.

Single person or 1000 married couple applies. Rate - VAT is levied at the standard rate of 20 with reduced rate of 55 of 10 applied to most food products and. Further cost of living measures such.

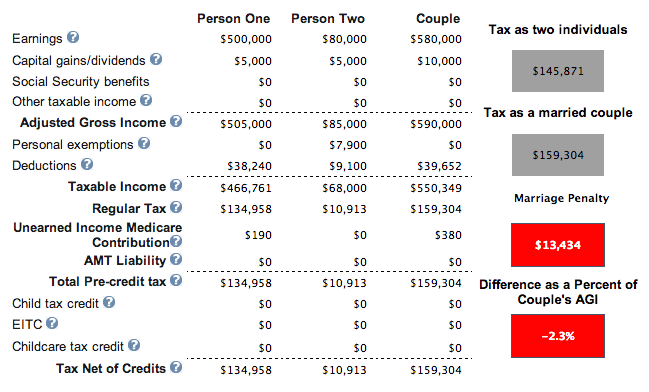

The latest budget information from April 2022 is used to. This calculator lets you create specific situations to see how much federal income tax two people might pay if they were to marry. Some states follow the federal tax.

This number is the gross pay per pay period. To use the tax calculator enter your annual salary or the one you would like in the Salary box. The calculator below can help estimate the financial impact of filing a joint tax return as a married couple as opposed to filing separately as singles based on 2022 federal income tax brackets.

If the spouse died after the end of 2011 the widow or widower can still be classified in the tax class III band. Calculate your Married Couples Allowance. The tax credit for 2022 can be claimed from early 2023.

The Take-Home-Pay As mentioned in the beginning this take-home-paycheck calculator is based on the tax brackets of last couple of years and therefore the results shown reflect the. Well go one step further and show you which tax bands you fall into too. The following applies to income tax 2013 for widowed persons.

How to use the Take-Home Calculator. You can use this calculator to work out if you qualify for Married Couples Allowance and how much you might get. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

The calculator does not take account of this. You need to be married or in a. To wrap it all up there will be a quick comparison between the take home pay from the year before so you can see.

It compares the taxes a married couple would pay filing a joint. The calculator below can help estimate the financial impact of filing a joint tax return as a married couple as opposed to filing separately as singles based on 2022 federal income tax brackets. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Your employer withholds a 62 Social Security tax and a. The state tax year is also 12 months but it differs from state to state. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

Choose your filing marital status from the drop-down.

Colorado Paycheck Calculator Smartasset

Getting Married What Newlyweds Need To Know Turbotax Tax Tips Videos

2022 Gross Hourly To Net Take Home Pay Calculator By State

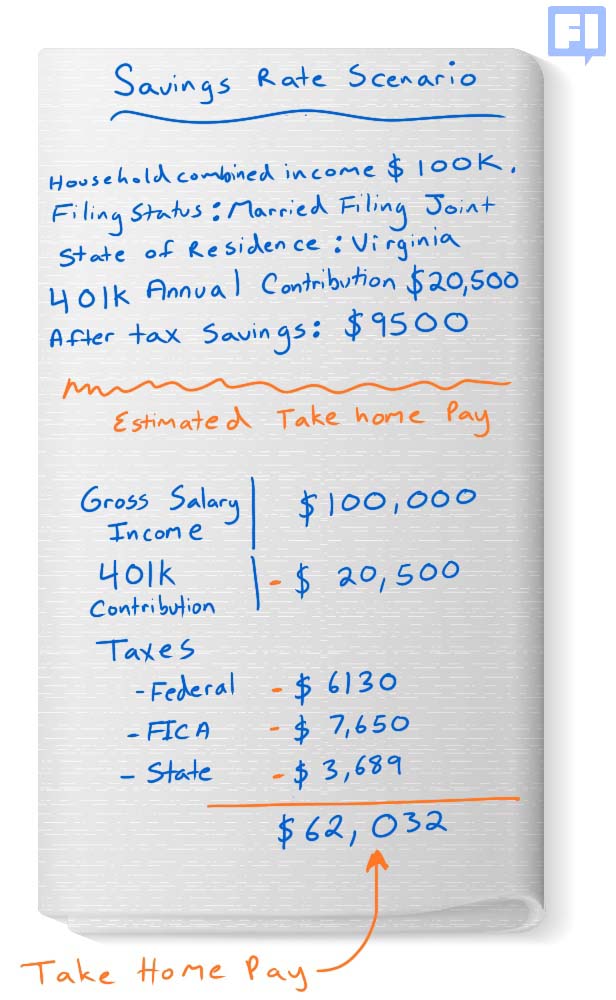

How To Calculate Your Savings Rate And Why It S Important Choosefi

Social Security Calculator 2022 Update Estimate Your Benefits Smartasset

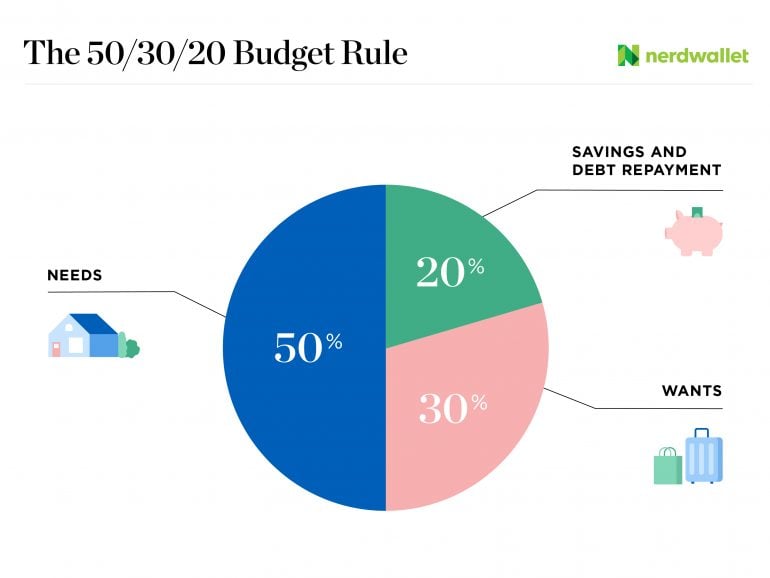

50 30 20 Budget Calculator Nerdwallet

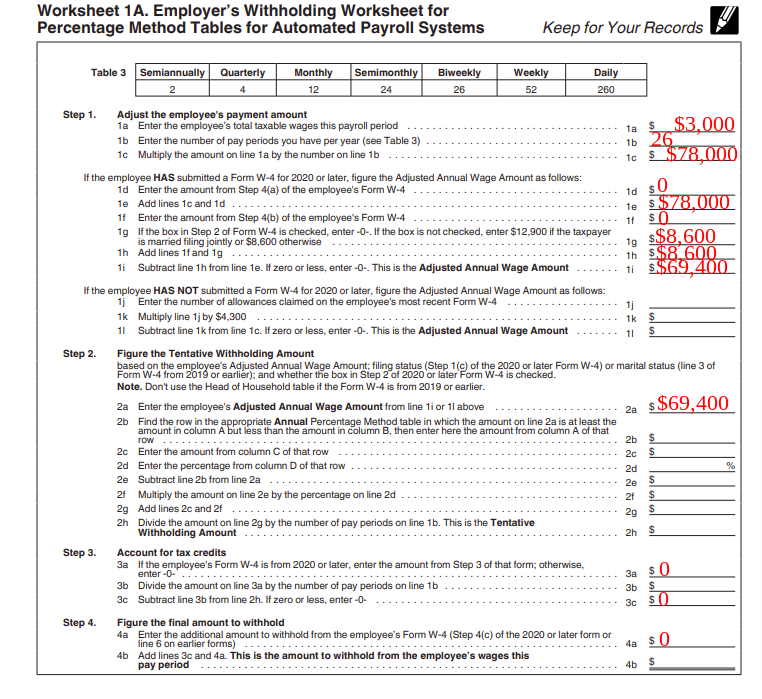

How To Calculate Payroll Taxes Methods Examples More

2022 Gross Hourly To Net Take Home Pay Calculator By State

Here S How Much Money You Take Home From A 75 000 Salary

How The 50 50 Path Helped One Couple Pay Off Their Mortgage In Four Years

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Salary Calculator Take Home Pay Calculator 2021 22 Wise

Salary Paycheck Calculator Calculate Net Income Adp

Surviving Off A 400k Income Joe Biden Deems Rich For Higher Taxes

The Average Net Worth For The Above Average Married Couple

At What Income Level Does The Marriage Penalty Tax Kick In

:max_bytes(150000):strip_icc()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png)